The Board of Directors of Agence France Locale – Société Territoriale, met under the chairmanship of Jacques Pélissard on March 30, 2018 and approved the Group’s audited consolidated financial statements for fiscal year 2017. The results confirm the growth of the Group’s bank.

In 2017, AFL’s credit commitments increased by 63% to close to €1.7 billion, driven by the continued expansion of the shareholding base. In 2017, AFL posted a positive gross operating income. Through three new capital increases, Agence France Locale stepped up the adoption of its model by a larger number of French local authorities.

In 2017, gross operating income was positive at €156 thousand due to the increase in net banking income (NBI) and good control of operating expenses.

According to Olivier Landel, Managing Director of Agence France Locale – Société Territoriale, « AFL reached breakeven in 2017. This success is first and foremost attributable to French local authorities which demonstrate, through AFL, the quality of their management, their professionalism and their diverse talents. The local authorities that have supported us since the beginning and those that have joined us along the way can be proud to have created and managed a fully-fledged bank with a light structure dedicated to their financing. » For Yves Millardet, Chairman of the Executive Board of Agence France Locale, « The bank’s operational teams are proud to have brought such a wonderful project to life. The forthcoming years will be dedicated to welcoming new members with the objective of offering all French local authorities – whether small or big, rural or urban – the financing benefits and security that AFL today offers to its 250 members. AFL is on track to meet the targets set out in its 2021 plan, namely capital pledges totaling €200 million and outstanding loans of €4 billion. »

The AFL Group’s main objective is to maintain a high rate of membership by new local authorities in order to support the continued increase in outstanding loans, in line with the 2017-2021 strategic plan.

Hence, it is expected that the size and structure of the AFL Group’s balance sheet will continue to change rapidly, as was the case in the last three years, with, firstly, continued loan production and, secondly, new capital increases in 2018.

For the first quarter of fiscal year 2018, the AFL Group has already carried out a capital increase, which saw the number of shareholders increase to 249 and the share capital of Société Territoriale increase to €142 million. This new operation once again shows that adoption of Agence France Locale’s model by local authorities remains dynamic.

The 2021 plan thus moves forward on a solid footing.

The loan portfolio reached close to €1.7 billion at December 31, 2017

· New credit commitments with member local authorities for the year 2017 stood at €722.5 million compared with €545.5 million for fiscal year 2016.

· Total credit commitments made since the AFL Group started its operations stood at €1,669.6 million.

· The launch at the end of 2016 of loans with progressive cash outflows and cash loans has met with growing success.

· A strong momentum was created, particularly with large local authorities.

Through three new capital increases, Agence France Locale stepped up the adoption of its model by a larger number of French local authorities

· Member shareholders of the AFL Group represent 15% of the total stock of outstanding debt of French local authorities.

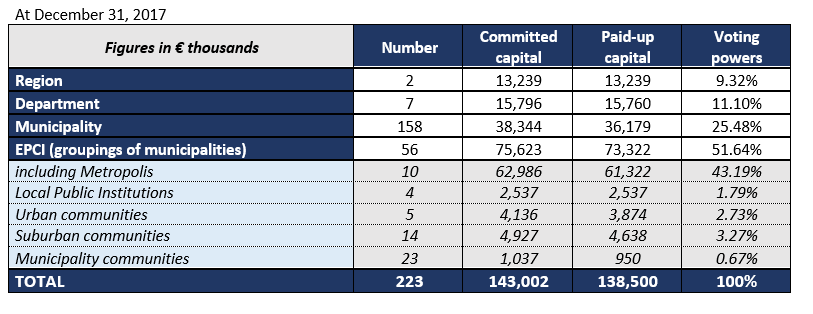

· Capital increases in 2017 resulted in membership by 50 new shareholders for a total of 223 local authorities and a total capital commitment of €143 million[1] for a Group paid-up capital of €138.5 million.

· The new members represent all types of local authorities.

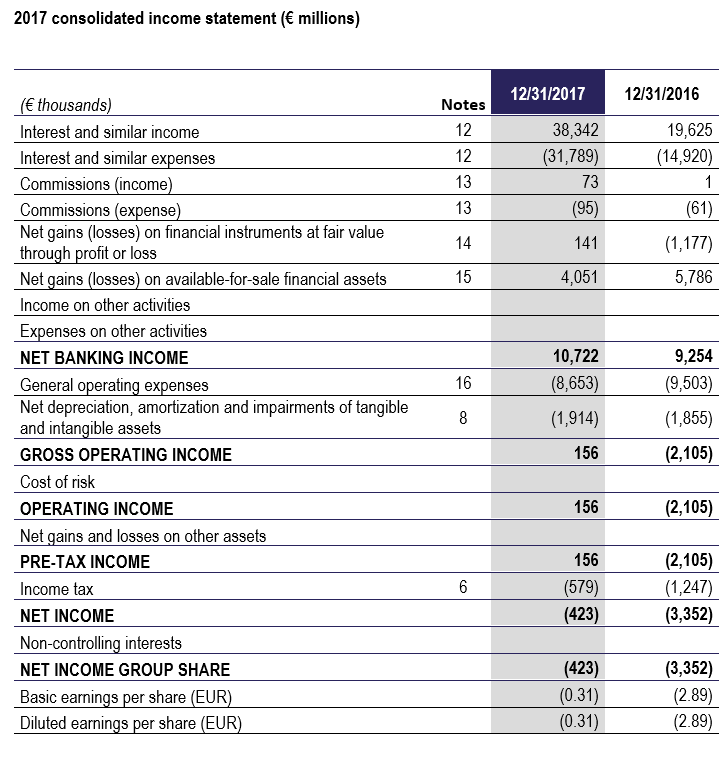

In 2017, gross operating income was positive at €156 thousand due to the increase in NBI and good control of operating expenses.

- NBI increased by €10.7 million driven by lending activities, refinancing on the markets with attractive terms and the results of the liquidity reserve management.

- Operating expenses remained stable at €9.1 million, excluding exceptional items.

A robust balance sheet

· Tier 1 Common Equity ratio: 24% on consolidated basis[2]

· Leverage ratio: 4.17% on consolidated basis

· Liquidity Coverage Ratio (LCR): 844.4%

· Net Stable Funding Ratio (NSFR): 188.8%

2017 Highlights

Increase in membership

The AFL Group closed its third year of activity on a successful note, with an increase in the number of local authority shareholders to 223 for a committed capital of €143 million and paid-up capital of €138.5 million[3]. The number of new members increased in all categories of local authorities.

Product portfolio and lending activities

In fiscal year 2017, AFL, the specialised credit institution, owned by Agence France Locale – Société Territoriale, stepped up the deployment of its long-term loans with progressive cash outflows as well as cash loans. The number of loans signed stood at 160, of which 23 for long-term loans with progressive cash outflows and 18 for cash loans.

Credit commitments made during fiscal year 2017 totaled €722 million for total outstanding loans signed of €1,669.6 million compared with €1,026.0 million at December 31, 2016, which represents a 63% increase in the AFL Group’s commitments.

The resulting outstanding loans at December 31, 2017, in accordance with IFRS, was €1,430.8 million of loans made available and €238.8 million of financing commitments.

Market activities

AFL carried out a number of funding operations on the bond market during fiscal year 2017 and started the issue of euro commercial paper on the money market.

The bond issues were made up of:

– a €250 million tap in January 2017 of the 2023 Eurobond series of €500 million

– a 2-year private placement of US$100 million

– a new benchmark 7-year fixed-rate euro-denominated issue of €500 million in May 2017 and

– a tap to this issue of €250 million in November 2017.

These issues reinforced AFL’s creditworthiness on capital markets and aligned the size of the three benchmark issues at €750 million each, thus increasing the liquidity of the notes.

These issues also allowed AFL to raise funds from a large number of investors and with very good terms, thus ensuring the continued competitiveness of the financing offer to member local authorities.

The ECP program drawdowns mainly in US dollars, offer AFL the opportunity to diversity its funds, with very attractive terms after exchange rate hedging.

Significant events since the balance sheet date

At the balance sheet date, the AFL Group had carried out a capital increase which ended on February 14, 2018, with €13.4 million of additional committed capital for a total of €156.4 million and paid-up capital of €142 million. This new operation once again shows that adoption of Agence France Locale’s model by local authorities remains dynamic.

AFL carried out, for the first time and with very good terms, 10-year and 15-year bond issues for €25 million and €100 million respectively, in the form of private placements.

The Group’s results (in accordance with IFRS standards)

At December 31, 2017, the NBI generated by the business reached €10,722 thousand compared with €9,254 thousand at December 31, 2016. It mainly corresponds to an interest margin of €6,552 thousand which increased sharply compared to €4,705 thousand recorded in the previous year, and net capital gains on investment securities disposals of €4,494 thousand and a negative revaluation of hedging relationships of -€303 thousand.

The interest margin of €6,552 thousand originates from the three following items:

· firstly, income related to the loan portfolio at €6,310 thousand, once restated for their hedges, which increased significantly compared with income of €4,747 thousand at December 31, 2016

· secondly, income related to the management of the liquidity reserve, negative of -€2,696 thousand, due to interest rates deeply anchored in negative territory and

· lastly, the debt interest charge, which for the reasons specified previously, represents a source of income standing at €3,132 thousand, once the income from its hedging is taken into account.

Capital gains on available for sales securities, for €4,051 thousand, relate to the management of the liquidity reserve portfolio over the period. These sales led concurrently to the cancellation of interest rate hedges for €443 thousand generating net overall capital gains of €4,494 thousand for the period.

At December 31, 2017, general operating expenses represented €8,653 thousand against €9,503 thousand at December 31, 2016. Personnel expenses accounted for €4,835 thousand of this figure, up compared with those of the previous year, which stood at €4,384 thousand. General operating expenses also include administrative expenses, which were down to €3,817 thousand compared with €5,119 thousand at December 31, 2016, after transfer of expenses to fixed assets. Once restated for a provision for risks and charges of €488 thousand which was recognized in 2016 and reversed in fiscal year 2017, administrative expenses declined compared with the previous year. This decline is mainly due to the reduction in fees for information systems and lesser recourse to external service providers.

After depreciation, amortization and provisions, amounting to €914 thousand compared with €1,855 thousand at December 31, 2016, operating income came into positive territory for the first time, and on an annual basis, at €156 thousand at the year-end compared with -€2,105 thousand for the previous year.

The changes brought about by the 2018 Finance Act to the corporate tax rate and the application of the liability method led to the recognition of a deferred tax liability of €577 thousand, thus reducing prior tax losses activated and amounting to €5,052 thousand at December 31, 2017 compared with €5,796 thousand at December 31, 2016. Tax losses recognized over the period did not give rise to the activation of any deferred tax assets.

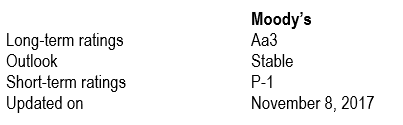

AFL rating

At December 31, 2017, AFL’s credit ratings were as follows:

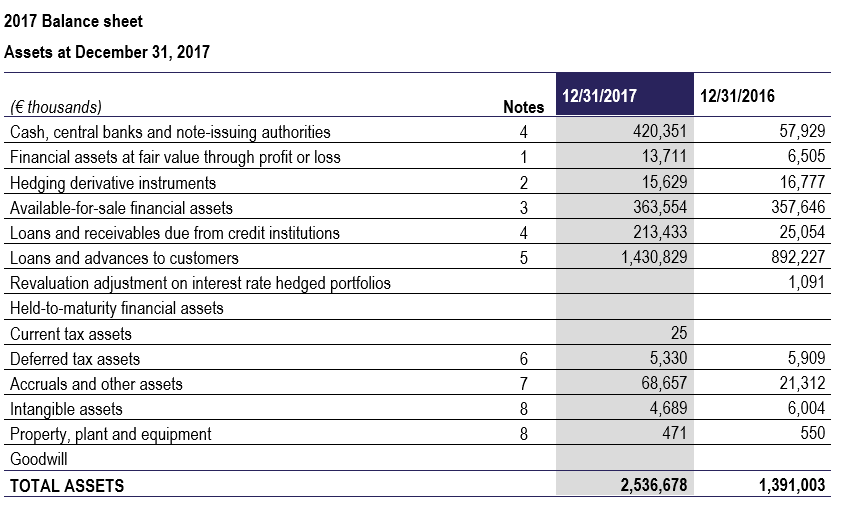

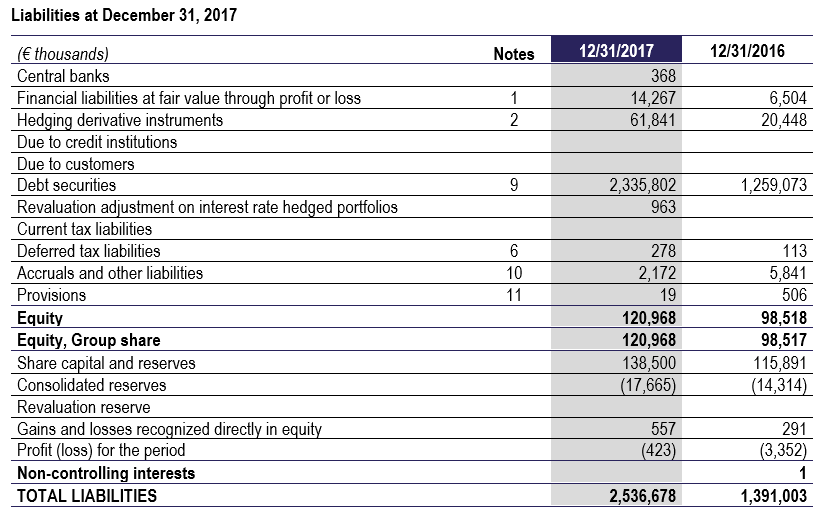

Balance sheet and financial structure of the Agence France Locale Group

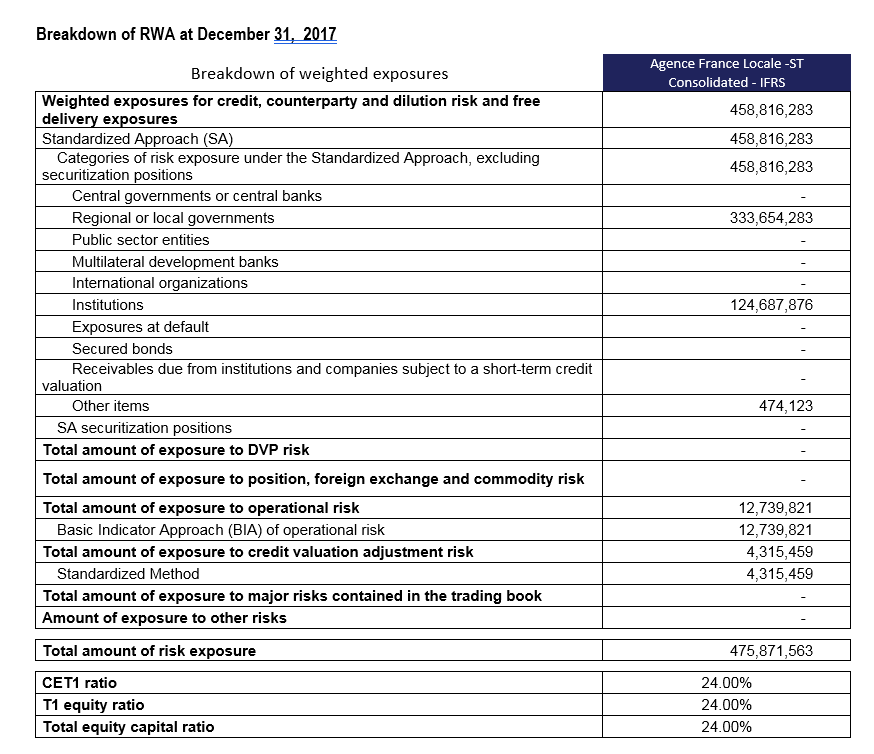

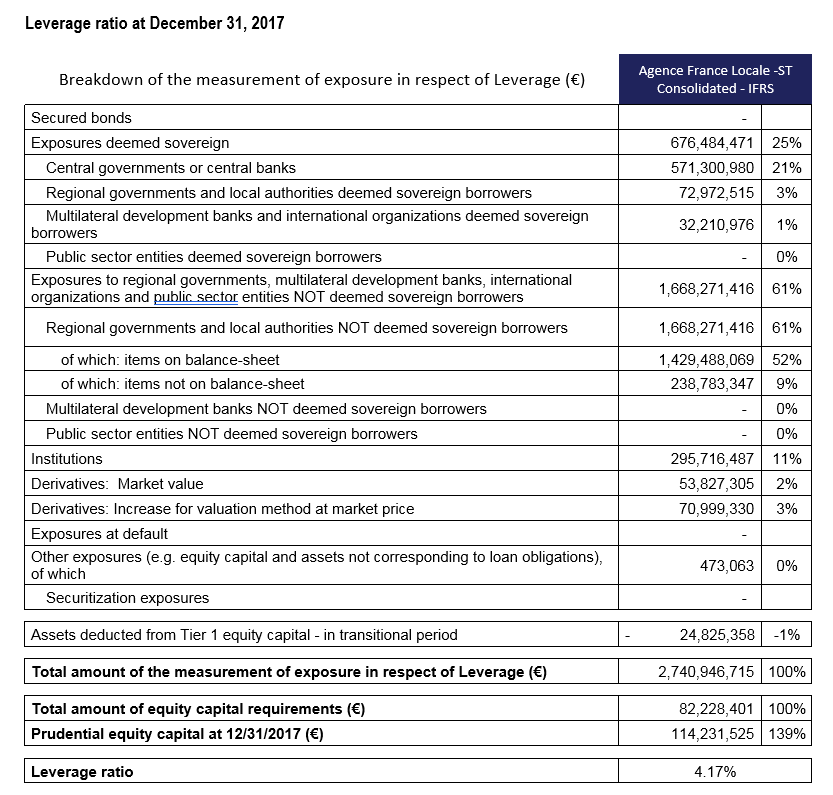

The AFL Group has a sound financial structure: prudential equity capital increased by €23.5 million to €114.1 million compared with €90.7 million at December 31, 2016. The risk-weighted assets, which reflect the quality of the AFL Group’s assets, stood at €475.9 million, broken down as follows:

· Credit risk: €459.4 million

· Operational risk: €12.9 million

· CVA risk: €4.3 million.

As a result, the Basel III solvency ratio based on the standardized method (Common Equity Tier 1) reached 24% on a consolidated basis. With regard to the prudential equity capital requirements set at 9.281% and the internal limit of 12.5%, the Group thus has a comfortable margin to continue with the rapid expansion of its lending activities while maintaining a robust financial structure.

According to the AFL Group, the impact of the first-time application of IFRS 9 on the CET1 ratio is not considered to be significant at January 1, the effective date of the standard.

The leverage ratio stood at 4.17%

In addition to this significant capitalization level, the liquidity position is very comfortable, reflecting the AFL Group’s good resilience to a liquidity shock, as shown by the high LCR and NSFR ratios which, on December 31, 2017, stood at 844% and 189%.

The outlook for the Agence France Locale Group

The AFL Group’s main objective is to maintain a high rate of membership by new local authorities in order to support the continued increase in outstanding loans, in line with the 2017-2021 strategic plan.

Hence, it is expected that the size and structure of the AFL Group’s balance sheet will continue to change rapidly, as was the case in the last three years, with, firstly, continued loan production and, secondly, new capital increases in 2018.

[1] At the date of publication of this press release, following the Group’s 15th capital increase, which ended on February 14, 2018, capital pledged stands at €156.4 million and paid-up share capital at €142 million for a total of 249 member local authorities including the membership of 26 new local authorities.

[2] As regards prudential requirements, Agence France Locale is monitored for the use of equity capital on a consolidated basis.

[3] At the date of publication of this press release and following the AFL Group’s 15th capital increase, which ended on February 14, 2018, capital pledged stands at €156.4 million and paid-up share capital at €142 million for a total of 249 member local authorities including the membership of 26 new local authorities.

The Statutory Auditors have audited the company and the consolidated financial statements. Certification reports will be submitted after completion of the other necessary procedures.

The financial information of the Agence France Locale Group for fiscal year 2017 includes this press release, together with the annual report available on the website www.agence-france-locale.fr